A few days ago I attended a great technical conference on the financing of public housing policies organized by the Housing Observatory of the Basque Country. The speakers were top-level professionals and they talked about the new (or not so new) ways to finance public housing policies. There was much talk about ICO, EIB, private investment funds, the powerful finalist public funding (only for public housing and urban policies) of France, our ancient mandatory reserve requirements for financial institutions (driven to the financing of affodable housing, among other aims), our privatized public bank sector or the social work of shaving banks. In times of credit crunch, financial and economic crisis it's positive to point out new ways to finance public housing policies. It's not so positive to uncritically try to finance onces more the Spanish public housing policies of the past decades (except quantitatively irrelevant examples, to build new "social" housing aimed almost entirely to the private property market, that quite often end to be empty housing units).

Colleagues with extensive experience in the world of urban planning also point out the difficult access to financing for private developers, as well as the draconian and suicidal conditions in public bids designed by our Public Administration in these times of general shortage. It's rather negative that the public contracts are tendered at prices impossible to fulfill (except by means of social dumping, lack of safety standards at work, etc). But it's even worse that many entrepreneurs go voluntarely to the slaughter, thinking like Margaret Thatcher that There Is No Alternative (TINA). Bid at impossible prices to die slowly or die at no matter what pace.

I have commented in recent months with active agents of Basque and Spanish real estate market that we see only two ways out of this sectorial quagmire: do things differently in Spain and Euskadi (housing rehabilitation, ecologial regeneration of existing urban tissues, etc.) or do what has been done in recent years in Spain overseas in dynamic markets in need for builders, developers, managers, architects, etc (China, India, Brazil, etc) . A couple of news on this second line of work: 1 and 2.

To my surprise I read in the electoral program of the futurre Prime Minister of Spain, Don Mariano Rajoy Brei, that the solution to the Spanish housing sector is the sanitation of our toxic real estate assets at market prices (prima facie a correct idea, but nobody says how and to whom are losses going to be asigned) to make the credit flow again to new residential developments and, together with a tuitive fiscal policy, hit once more to the "good" old times of a the past decade.

Faced with this situation, colleagues and other real estate agents we all ask ourselves the same question: Are we going to return to encourage irresponsible loans to build more houses tagged with golden prices intended to be acquired by people unable to face mortage payments and along with it sink a few more entrepreneurs, financial institutions, as well as fire a bit more up unemployment, private and public debt? Will we be so stupid? Well, it seems that the answer it is going to be yes.

Along with this, a friend tells me that we must go back to the ministerial speech of presentation of the Law 6/1998 on land and valuations, the kick off of our past "glorious" real estate decade. It appears that some seriously think that the best way to get rid of the painful effects of a good hammer on a finger, is to go for another good hammer in the exact same finger.

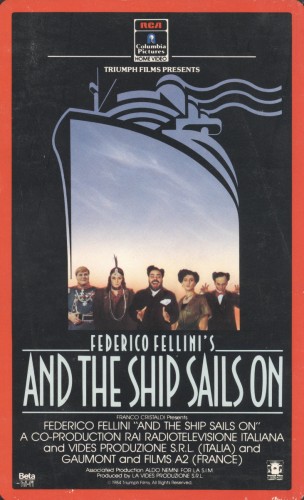

Futile efforts produce melancholy, we say in Spain. The irresponsible ones are also counterproductive. And as in Fellini's capolavoro E la nave va, confident, graceful, proud and even poetical the ship drifts (we continue to build new homes -almost 100% mortgage and property-, while more than two million dwellings are unused, timid whispers point to the need for financial orthodoxy, we read in the offical records the postmortem examination of the iconic urban nightmare of Seseña, experts speak out, with little response by politicians or financiers, for a Spanish convergence with the EU rental system, some unions call for a hair cut also in individual mortgages and not only in public debt, Obama continues his fight against housing over-borrowing and evictions, we withness evictions of ordinary people every day here in Spain, the "old" law on express eviction dies and the ultra express eviction is born, and occupation appear to have not only a residential purpose but a politial one as well) to the disaster ...

ARTICULOS ANTERIORES EN ESTE BLOG QUE TRATAN DE TEMAS RELACIONADOS Y QUE PUEDE INTERESARTE: